“The Government announced its Budget on 3 March 2021. Here are key excerpts from the budget that are relevant to businesses in Cambridge & Peterborough.”

– Paul Webster, Growth Works Programme Director

Overview – Building back better:

The government is committed to stimulating private sector investment to create jobs, develop hubs of innovation, and revitalise local areas and regions across the UK. The package of measures announced at the Budget will protect jobs, support businesses and boost output over the short term.

The government is committed to stimulating private sector investment to create jobs, develop hubs of innovation, and revitalise local areas and regions across the UK. The package of measures announced at the Budget will protect jobs, support businesses and boost output over the short term.

While many firms have been hit hard by the pandemic, data suggests that in aggregate firms accumulated additional savings of close to £100 billion between March and December 2020. The cost of corporate borrowing from banks was also down to 1.9% in December 2020 from 2.7% in January 2020.

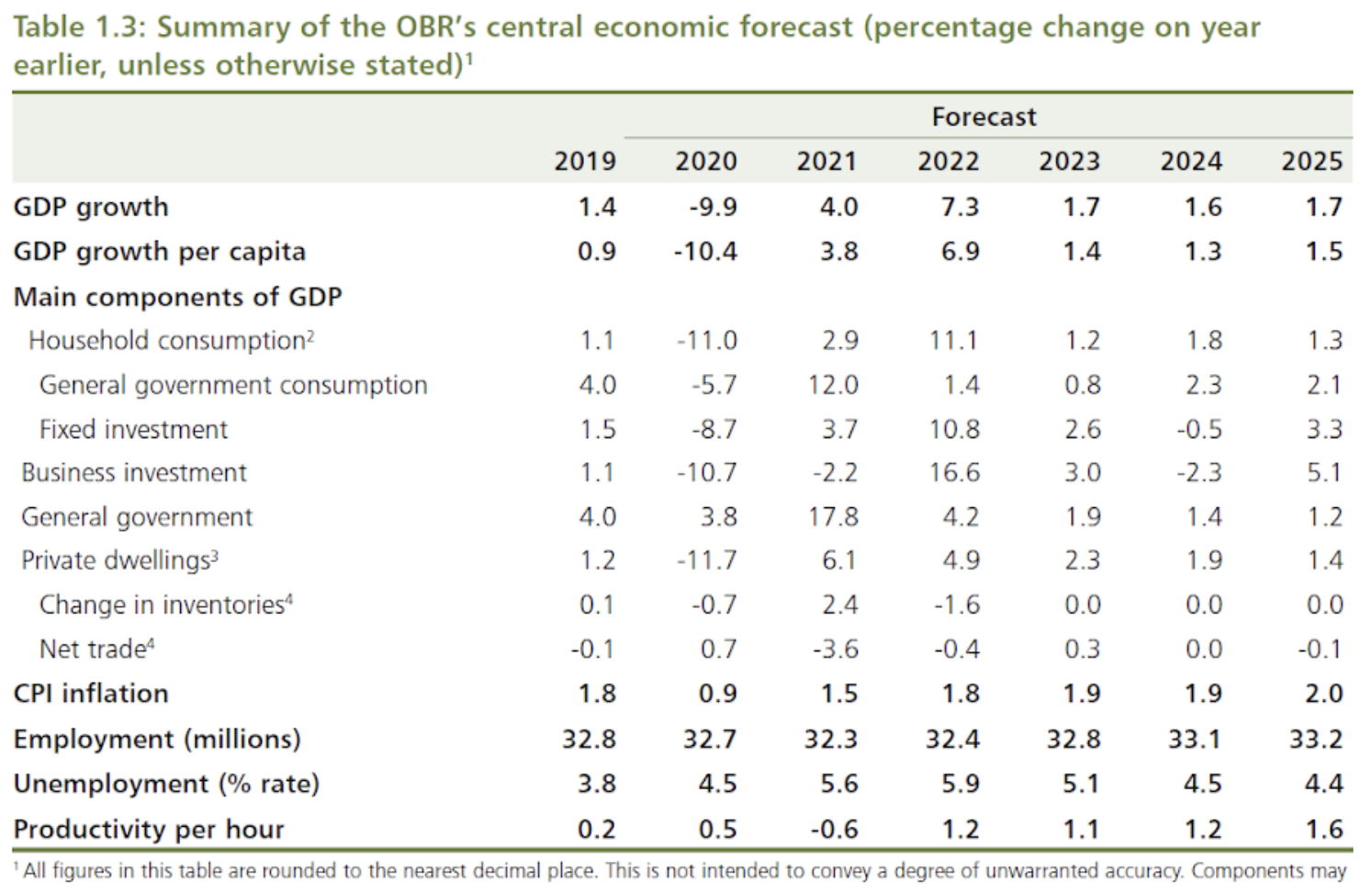

Economic growth was stronger at the end of last year than the OBR expected in their November forecast, with output ending the year 6.3% below its February 2020 level, around 1 percentage point higher than originally estimated.

Following an expected 3.8% fall in GDP in the first quarter, GDP is expected to increase by 3.9% in the second quarter and is then by 3% and 3.3% in the third and fourth quarters. Annual growth is expected to be 4% in 2021.

While the unemployment rate is expected to peak in the fourth quarter of this year, at 6.5%, this is 1 percentage point below the peak in the OBR’s November forecast. The unemployment rate then falls to 4.4% at the end of 2024.

The OBR judge the temporary increase to capital allowances announced at Budget will increase the level of business investment by approximately 10% at its peak in 2022-23, equivalent to around £20 billion per year.

The Budget recognises that innovative, fast-growing firms will likely be a key driver of future growth – despite accounting for less than 1% of UK companies, such firms add £1 trillion to the UK economy. The Budget includes several measures to support these firms, including:

- support for SMEs to boost their digital and management capabilities

- a UK Infrastructure Bank with £12 billion of equity and debt capital to finance local authority and private sector infrastructure projects across the UK

- a new £375 million fund to help scaleup the most innovative, R&D intensive businesses

These actions will also help spread opportunity across the UK, achieving the government’s ambition of levelling up every part of the country. They will also be crucial to supporting the government’s vision for a Global Britain and contributing to the transition towards a net zero society.

Support for jobs:

- High quality traineeships for young people – The government will provide an additional £126 million in England for high quality work placements and training for 16-24 year olds in the 2021/22 academic year. Employers who provide trainees with work experience will continue to be funded at a rate of £1,000 per trainee.

- Payments for employers who hire new apprentices, extend and increase the payments made to employers in England. Employers who hire new apprentices between 1 April 2021 and 30 September 2021 will receive £3,000 per new hire.

- Supporting apprenticeships across different employers – The government will introduce and expand portable apprenticeships to enable people who need to work across multiple projects with different employers to benefit from the high quality long-term training.

Support for businesses to recover:

- From 6 April 2021 the Recovery Loan Scheme will provide lenders with a guarantee of 80% on eligible loans between £25,000 and £10 million to give them confidence in continuing to provide finance to UK businesses.

- The government will provide ‘Restart Grants’ in England of up to £6,000 per premises for non-essential retail businesses and up to £18,000 per premises for hospitality, accommodation, leisure, personal care and gym businesses, giving them the cash certainty they need to plan ahead and safely relaunch trading.

Encouraging business growth:

- Help to Grow: Digital – The government will launch a new UK-wide scheme in the autumn to help 100,000 SMEs save time and money by adopting productivity-enhancing software. This will combine a voucher up to a maximum of £5,000, and free impartial advice, delivered through an online platform.

- Future Fund: Breakthrough – The government will commit £375 million to a new direct co-investment product to support the scale up of the most innovative, R&D-intensive businesses. The British Business Bank will take equity in funding rounds of over £20 million (cash raise) led by private investors.

- Highly Skilled Migration – The government will:

- Reform the Global Talent visa, including to allow holders of international prizes and winners of scholarships and programmes for early promise to automatically qualify.

- Review the Innovator visa to make it easier for those with the skills and experience.

- Provide practical support to small firms in CPCA that are using the visa system for the first time.

- Modernise the immigration sponsorship system to make it easier to use.

Investing together with the private sector:

- UK Infrastructure Bank – Will provide financing support to private sector and local authority infrastructure projects across the UK, to help meet government objectives on climate change and regional economic growth. The Bank will be able to:

- establish an advisory function offer a range of financing tools including debt, hybrid products, equity and guarantees to support private infrastructure projects

- from the summer, offer loans to local authorities at a rate of gilts + 60 basis points for strategic infrastructure projects

- UK Community Renewal Fund prospectus launch – The £220 million fund will support communities across the UK in 2021-22 to pilot programmes as the government moves away from the EU Structural Funds model and towards the UK Shared Prosperity Fund. Funding will be allocated competitively. The government has identified 100 priority places based on an index of economic resilience to receive capacity funding to help them co-ordinate their applications.

- Community Ownership Fund – The government will create a new £150 million fund to ensure that communities continue to benefit from the local facilities and amenities that are most important to them. Community groups will be able to bid for up to £250,000 matched funding to help them to buy local assets to run as community-owned businesses.

Updates to Corporation Tax:

- Corporation tax – The rate of corporation tax will increase from April 2023 to 25% on profits over £250,000. The rate for profits under £50,000 will remain at 19% and there will be relief for businesses with profits under £250,000 so that they pay less than the main rate. The Diverted Profits Tax rate will rise to 31% from April 2023 so that it remains an effective deterrent against diverting profits out of the UK.

- Super-deduction – From 1 April 2021 until 31 March 2023, companies investing in qualifying new plant and machinery assets will benefit from a 130% first-year capital allowance. This upfront super-deduction will allow companies to cut their tax bill by up to 25p for every £1 they invest. Together with CPCA’s capital growth grants this is a brilliant initiative. Investing companies will also benefit from a 50% first-year allowance for qualifying special rate (including long life) assets.

Other interesting changes:

- Contactless payment card limit to increase – The government has approved an increase to the legal contactless payment limits to allow single contactless payments up to £100, and cumulative contactless payments up to £300.

- Film and TV Production Restart Scheme – The government will extend the £500 million Film and TV Production Restart Scheme for six months to 31 December 2021 to continue to support the UK screen production industry.

- Green energy innovation schemes – The government’s £1 billion Net Zero Innovation Portfolio will be used to support the development of new solutions to cut carbon emissions and accelerate near-to-market low-carbon energy innovation.